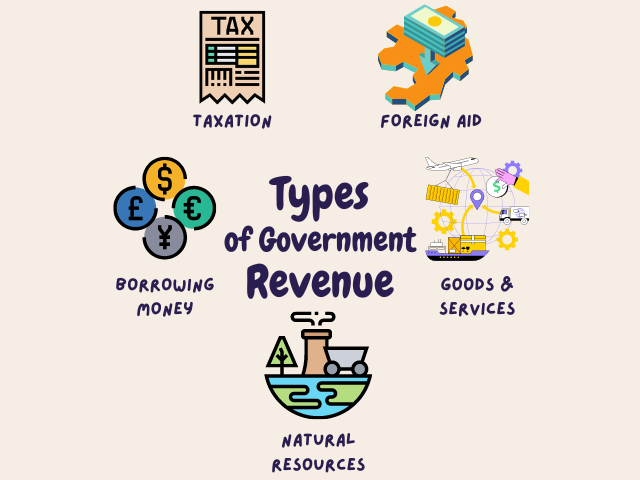

Types of Government Revenue

This blog post will educate you on how the different types of government revenue is managed and distributed, and the impact it has on the economy, society, environment, the citizens and the country's development.

What is government revenue?

It refers to the funds that a government collects from various sources to finance its activities and services. This revenue can come in the form of taxes, fees, fines, grants, and other sources

Governments require revenue to fund various public services and infrastructure projects. This revenue is collected through various means such as taxes, fees, and fines.

Understanding the different types of government revenue is essential for individuals and businesses as it helps them understand their tax obligations and the distribution of public funds.

Types of Government Revenue

The following are a variety of sources of revenue that the Government's can use to fund its operations:

- Individual Income Tax;

- Corporate Income Tax;

- Social Insurance Tax;

- Federal Excise Tax;

- Customs and Tariffs;

- Foreign Aid;

- Sales of goods and services;

- Borrowing money;

- And Natural Resources.

Further Details

Taxation

Every country has their own types of taxes and tax structures.

Taxes are the most common type of revenue, especially in democracies, it is a mandatory fee enforced by the government in order to fund various public expenses

The following are examples of public expenses:

- infrastructure;

- education;

- healthcare;

- and social welfare programs.

Individual Income Tax

An Individual's earnings is taxed whenever it reaches a certain amount imposed by the government, typically, the higher your individual earnings, the lower your tax rates, though it depends on how the tax systems of a government is formed. This affects everyone, workers, business owners, freelancers etc.

Social Insurance Tax

Social Insurance Tax, also known as payroll tax, this type of tax is typically a percentage of an employee's salary and is automatically withheld from their paychecks by their employer.

Its purpose is to ensure that important social programs like Social Security, are adequately funded.

Do self-employed individuals pay payroll tax?

Yes, but because self-employed individuals don’t withhold taxes from their own paychecks, they are required to estimate and pay tax payments to the country's tax agency.

Federal Excise Tax

This is the type of tax you pay for purchasing specific products, such as Alcoholic beverages, Cigarette, Gasoline, Tires, Airline tickets, imported goods, etc.

Aside from imposing this type of tax for the sake of revenue, its main purpose is to regulate industries, to protect domestic industries from foreign competition, and to discourage the use of specific products like cigarettes and alcohol beverages.

Customs and Tariffs

Imported and Exported Goods are also taxed.

Its purpose, aside from being a significant source of revenue, is to impose a higher burden on foreign industries by making imported goods more expensive, and thus less competitive.

Foreign Aid

Foreign aid, a financial aid provided from another country, is given in exchange for the government of the country to perform an action or enact programs and policies that the donors want.

the following are examples on where foreign aid can be used:

- Building schools, roads, and other infrastructures;

- Repair broken homes that caused by natural disasters;

- Providing food, shelter, and medical assistance;

- Vaccination campaigns;

- Waging and pursuing war;

- etc.

Although foreign aid is typically gifted for the sole purpose of benevolent reasons, it can also be used to promote their own economic and political interests.

One reason a country may provide aid to another country is to gain access to its natural resources or establish a military presence in the region.

Foreign aid is used to influence another country's decision, regardless of the reason for giving aid is benevolent, pragmatic, or malevolent in nature.

Sales of Goods and Services

Governments may generate revenue by selling goods or services to the public or to other nations. It can involve both domestic and international sales.

This can include a wide range of products and services, including but not limited to:

- Construction and consulting services;

- State-owned enterprises;

- Land and property;

- Equipment and technologies;

- and charging tickets and fees that they sponsor or organize.

This type of tax provides one of most stable and predictable sources of income, unlike taxes, which can fluctuate depending on the country's economic conditions.

Though the sale of goods and services has the capability to generate significant income, it normally does not generate as much as revenue as other sources of revenue, like taxes.

Borrowing Money

Borrowing can be a useful source of revenue for governments when it is used prudently and in moderation.

Governments can borrow money from a variety of sources, including, but not limited to:

- Financial Institutions;

- Investors;

- International Organizations;

- and from other governments.

If a government relies heavily on borrowing money to fund its operations, however, it can lead to an unsustainable level of debt, which can create financial problems for the government and for the country.

Incurring debt today is attractive because, after all, the debt will be inherited by the next administration. - From the Dictator's Handbook

In addition, a high level of debt may make it more difficult for the government to borrow money in the future or to attract investors.

Natural Resources

Natural resources are materials available on the planet that are found in nature. Depending at the type of resource, it can be sold for a high price in large quantities, because of their economic and societal benefits. This includes oil, coal, fertile lands, metals, etc.

However, depending on the country, natural resources may not always be a reliable and sustainable source of revenue for the government.

Additionally, the extraction and production of natural resources can be environmentally damaging.

It's also worth noting that, Autocracies and Dictatorships tend to possess an abundance of natural resources that is valued greatly.

CONCLUSION

- Taxation is a mandatory fee that is enforced by the government, it is used to fund various public expenses, such as: public infrastructure, social programs, the public servants' salary, etc.

- Foreign aid is a donation from foreign entities with the intent to get the country's government to perform a desired action.

- Government can earn revenue through international and domestic regions by selling products and services.

- Governments ought to be careful when considering their borrowing needs and to manage their debt levels in a responsible manner.

- The extraction, production, and sale of natural resources has the capability to generate significant income for the government.

Copyright ©2023 by Marshall Vulta

Comments ()